The first quarter of 2020 started off well but didn’t end that way. At the beginning of the year, we expressed concerns over the level of market valuations, rising global debt levels, international trade disputes and their effect on supply chains and business planning as well as other geopolitical tensions. Admittedly, we did not factor in a sudden GLOBAL PANDEMIC!

FIRST QUARTER 2019 RETROSPECTIVE AND PROSPECTIVE – What a difference a quarter makes!

FIRST QUARTER 2019 RETROSPECTIVE AND PROSPECTIVE

What a difference a quarter makes!

“Markets are born in pessimism, mature on optimism and die of euphoria.” Sir John Templeton

A euphoric start to 2019!

After a dismal end to last year, global stock markets rebounded in the first quarter making up much of the ground lost in the final quarter of 2018. The underpinnings of this sudden reversal in sentiment are less clear. There appears to be a disconnect between the direction of the stock markets and the direction of the global economies. Economists continue to moderate the outlook for future economic growth. The issues that vexed the markets in 2018 remain and in many cases, those issues have deteriorated even further.

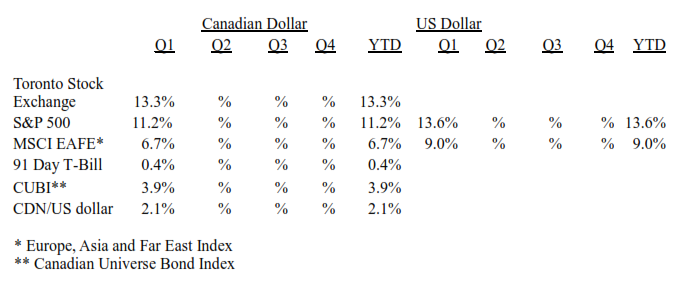

Nevertheless, investor enthusiasm drove markets higher. In Canada, the S&P/TSX Total Return Index advanced 13.3% in the first quarter of 2019. The US market advanced 13.6% in the quarter as measured by the US dollar denominated S&P 500 Total Return Index. The S&P 400 MidCap Total Return Index fared even better producing a 14.5% return in this quarter. Markets represented by the MSCI EAFE Price Return index posted a positive 9.0% return as measured in US dollars or a 6.7% return in Canadian dollars. The Canadian dollar appreciated 2.1% to its US counterpart in Q1.

Stock markets have been robust since the lows of late December in spite of continual reductions in the outlook for global economic growth. Over the past year, the sentiment has changed from expectations of synchronized accelerating growth to expectations of synchronized decelerating growth.

On a relative basis, the US economy has been more resilient as gains in wages and employment have been reported. In the third quarter of 2018, the US economy was growing at a 3% rate. However, the government shutdown will have a profound effect on the first quarter as it has been estimated that it reduced daily GDP by as much as 1.5% per day that it continued. Over the next two months, first quarter earnings will be closely observed as earnings growth will likely be diminished compared to last year where earnings got a boost from the sharp reduction in tax rates. A large portion of the enhanced earnings were distributed to shareholders by way of dividends and share buybacks as opposed to being invested in capital expenditures to promote future growth.

The European economies have been less buoyant as trade wars are creating a drag on economic growth. Germany has been the primary driver of economic activity but growth has been decelerating faster than anticipated. Italy actually recorded a technical recession with two quarters of negative GDP growth. Beyond the trade wars, Brexit is responsible for a great deal of uncertainty as factors such as the trade in goods and services, the mobility of employment, and the direction of capital flows are all in question. Each of the 27 remaining countries in the European Union all have varying exposures to these factors with the UK.

The Chinese economy continues to expand at a rate faster than the developed economies, but its growth is also decelerating and that is having a major impact on its trading partners. The trade war with the US had an impact as well. Also, the Chinese economy has grown to the point where it is less dependant on foreign flows as much more is produced locally. However, massive debt has accumulated in China which creates a conundrum for authorities wishing to stimulate growth, or at least arrest the decline in activity.

Japan continues to reel from slow growth and aging demographics and the other emerging economies are feeling the effects of the slower global activity.

In Canada, conditions continue to deteriorate. Economic activity was expected to be strong at the beginning of 2018 but came in at 1.8% for the year, well below the US at 2.9%. Consumer spending in Canada was the weakest in six years. It is estimated the fourth quarter GDP growth was a meagre 0.4% annual rate held up in part by rising inventory levels. The woes of the Canadian energy sector are well known, but business investment is down overall. A survey conducted for the insolvency firm MNP Ltd. indicated that 46% of Canadians estimate that they are $200 away from insolvency.

Global GDP growth slowed to a 3.6% annual rate last year and the OECD projects that 2019 growth will slow even further to 3.3%. The response by central banks has been to do an about-face. Where rate increases were anticipated last year when growth was viewed as accelerating, a more benign stance has been adopted as rate increases, at least for the time being, are on hold.

Helicopter governments and their agencies have managed to postpone a recession for some time and may do so for a while yet. Eventually, the capitalist forces of creative destruction will take hold and the excesses of the past ten years will be dealt with.

You can view our complete commentary and download your own copy:

FIRST QUARTER 2019 FIXED INCOME COMMENTARY

“The knowledge jobs will go, the wisdom jobs will stay.” ~ Anonymous

After the rapid decline in interest rates in the latter part of 2018’s fourth quarter, interest rates continued to decline during the first quarter. Weaker than expected economic indicators resulted in central banks on both sides of the US/Canadian border to refraining from interest rate increases at this time. Furthermore, the statements from the central banks indicate an increased level of caution leading to a lack of enthusiasm for further interest rates hikes, possibly for the rest of the year.

Short-term interest rates increased relative to longer ones resulting in ten-year rates flirting with an inversion whereby short rates are higher than longer ones. An inverted yield curve is considered a classic sign of a forthcoming recession.

Normally, central banks raise short term interest rates in order to cool inflationary pressures which causes the yield curve inversion. This time is different as longer term interest rates have been declining, arguably indicating that the market participants foresee lower rates going forward. Nevertheless, this may also foretell a decline in economic activity….certainly, food for thought!

As the first quarter progressed, Brexit appeared to shift evermore towards “Wreck”-xit. Clearly, there is no political consensus on any type of exit formula except for the statement that there has to be an agreement with the EU before a withdrawal can occur. However, if no agreement can be forged, the option of not leaving will be a decision for the EU to make.

No matter what the outcome, what is certain is that the political ill-will and the polarization in the electorate will bedevil UK politics for a generation to come.

President Trump will get his opportunity to influence the direction of the Federal Reserve as there are two vacancies on the seven member governing board. While clearly this may influence decision making to some extent, we have noted on previous occasions that interest rate decisions are arrived at in a consensus based decision making process. In light of this, it is unlikely that major swings in policy will be forthcoming. Economic fundamentals will have a much larger impact than politics!

The total return performance of the bond market as measured by the FTSE TMX Canada Universe Bond Index for the first quarter was an increase of 3.9%. 91-day Treasury bills returned 0.4% over the same period.

The benchmark ten-year Government of Canada bond yield declined by 0.34% over the course of the first quarter to end the period with a 1.6% yield. Over the same period the Canadian dollar appreciated by 1.5 cents from 73.3 cents US to 74.8 cents US.

We believe clients are more concerned about losing money than making speculative gains. Like to learn more? Please contact us here>>

The opinions expressed here are ours alone. They are provided for information purposes only and are not tailored to the needs of any particular individual or company, are not an endorsement, recommendation, or sponsorship of any entity or security, and do not constitute investment advice. We strongly recommend that you seek advice from a qualified investment advisor before making any investment decision.